Opay, like many financial service providers, maintains transaction histories for several reasons. Firstly, these records serve as a form of documentation for both the user and the company. They provide a detailed account of financial activities, which can be essential for tracking expenditures, managing budgets, and reconciling accounts.

Moreover, transaction histories contribute to the security of the platform. They allow users to review their past transactions, which can help them identify any unauthorized or fraudulent activities. In case of disputes or discrepancies, having a comprehensive transaction history can provide evidence and facilitate resolution.

From a regulatory perspective, maintaining transaction histories is often a requirement to ensure compliance with financial regulations and anti-money laundering measures. These records may be subject to audit or review by regulatory authorities.

Therefore, the presence of transaction histories on Opay is not merely a matter of policy, but it's also fundamental for maintaining the integrity and security of the platform, as well as meeting regulatory requirements.

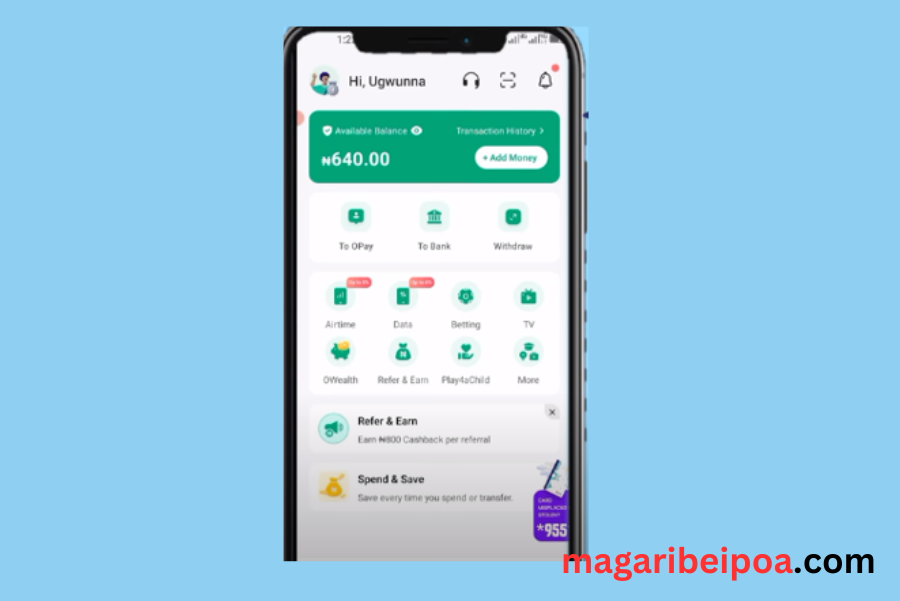

About the app

Opay is a financial technology company that provides various digital financial services, including mobile money, payment processing, and financial management solutions. Originally founded in 2018 in Nigeria, Opay has rapidly expanded its operations across Africa and beyond, offering services such as money transfers, bill payments, airtime purchases, and ride-hailing through its mobile app.

Comments